Inclusive financial service refers to providing access to a broad range of affordable and useful financial products and services to people who are traditionally excluded or underserved by the formal financial sector. These services are designed to be accessible, particularly to low-income individuals, small businesses, and rural communities, enabling them to participate in the economy and improve their financial well-being.

The primary goal of inclusive financial services is financial inclusion, ensuring that everyone, regardless of their socioeconomic status, has access to basic financial tools such as savings accounts, credit, insurance, and payment systems. These services are essential for helping people save for the future, manage risks, make investments, and support personal or business growth.

Key Characteristics of Inclusive Financial Services

Inclusive financial services empower individuals and small businesses to achieve greater financial stability and economic participation. Below are the key characteristics of inclusive financial services that ensure broad access to financial service at an affordable cost particularly for underserved populations:

These characteristics ensure that financial services can reach, serve, and benefit people of all backgrounds, enabling a more equitable financial ecosystem.

- Accessibility: Services are available in remote and underserved areas, often through digital platforms, mobile banking, and microfinance institutions.

- Affordability: Inclusive financial services must be priced affordably so that even low-income individuals can use them without facing financial strain.

- Simplicity and Usability: The services are designed to be easily understood and used by people who may have limited financial literacy.

- Comprehensive Offerings: Inclusive financial services provide a range of products, from basic savings and credit to micro-insurance and pensions.

These characteristics ensure that financial services can reach, serve, and benefit people of all backgrounds, enabling a more equitable financial ecosystem.

Components of Inclusive Financial Services

Inclusive financial services encompass a range of products, delivery mechanisms, and support systems to meet the financial needs of underserved populations. Here are the main components that make inclusive financial services effective and accessible:

- Savings and Deposit Accounts: Allow individuals to store money securely and build financial resilience.

- Credit and Micro-Loans: Provide financing options for low-income individuals and small businesses who lack collateral or a credit history.

- Insurance: Products such as health, life, and crop insurance protect vulnerable populations against unexpected risks.

- Payments and Remittances: Enable easy, cost-effective ways to send and receive money, often crucial for rural and remote communities.

- Financial Literacy Programs: Help individuals understand how to use financial services effectively, promoting sustainable financial behaviors.

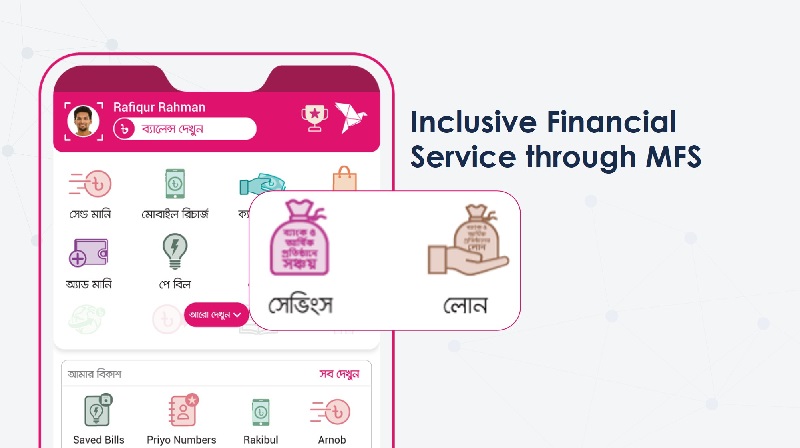

Overview of bKash’s Digital Loan

bKash, in partnership with The City Bank PLC, offers digital loans that are quick, convenient, and accessible to a broader range of users. This product caters primarily to individuals with limited or no credit history, who might struggle to secure a loan through traditional means. The main objective of launching this digital loan is to accelerate financial inclusion of the country’s underprivileged population, especially women and people living in rural areas by ensuring their access to credit. The bKash digital loans work as per following process:

- Eligibility and Access: Users who have an active bKash account and maintain regular transactional activity are assessed for loan eligibility. This ensures that even users without a formal credit score can qualify for loans based on their transaction history.

- Loan Application: Customers can apply for loans directly from the bKash app with a few taps. The entire process is digital, eliminating the need for physical paperwork or visiting a bank.

- Loan Disbursement and Repayment: Approved loans are disbursed instantly into the user’s bKash wallet, and repayments can be made through the app. The repayment terms are transparent, with clear schedules and amounts provided to users.

As per the directives from central bank, bKash customers who have completed e-KYC through biometric system and using bKash app, are considered eligible for this loan. Based on the customer’s transaction in bKash account and City Bank’s credit risk management policy, the customer’s loan eligibility and loan amount are determined through an automatic credit assessment system. The key features of the loan are –

- Fully digital process, from application to disbursement to repayment

- Loan disbursed instantly in customer bKash account

- The ‘nano loan’ ranging from Tk 500 to Tk 20,000 from the City Bank

- Customers don’t need to go to any office or sign any document

- Customers don’t even need nominee or guarantor for the loan

- Validity of this loan is maximum of three months

- Interest rate is determined on daily basis

- Loan installments automatically deducted from the bKash account on due date However, the borrower can also repay the loan even before repayment date

Impact of bKash Digital Loans

As per official information, bKash customers have taken more than BDT 7 billion worth of loan from City Bank using the bKash app. This product was launched as part of a joint initiative of bKash and City Bank to enhance the digital transaction ecosystem in Bangladesh. Till now, over 245,000 bKash customers have availed this collateral-free ‘nano loan’ for 0.7 million times.

Furthermore, it was confirmed by officials that, as of 2023, 24 percent of these customers are women and 55 percent of the total borrowers live in rural areas. Considering the patterns and demographics of the customers, more illustrative impacts can be summarized as below:

- Empowering Small Businesses: Digital loans provide small business owners and entrepreneurs with much-needed capital for inventory, operations, and expansion, supporting economic growth at the grassroots level.

- Emergency Funds for Individuals: Digital loans offer a financial safety net for individuals who need immediate cash for unexpected expenses, such as medical emergencies or urgent family needs.

Overview of Digital Deposit Scheme (DPS) by bKash

The Digital Deposit Scheme (DPS) offered by bKash is designed to encourage savings among users, allowing them to plan for their future. This product is particularly valuable for individuals who lack access to traditional savings accounts or formal pension schemes. The bKash digital DPS work as per following process:

- Collaboration with Banks: The DPS feature on the bKash platform is offered in partnership with banks, where users can create and manage their pension accounts digitally. Currently, bKash offers DPS from BRAC Bank, Dhaka Bank, Mutual Trust Bank, IDLC Finance and City Bank (Islamic DPS).

- Flexible Savings Plans: Users can choose the amount they wish to deposit regularly, making the DPS scheme highly adaptable to various income levels. This includes monthly/weekly deposit amount from BDT 250 to BDT 10,000 with 6 months to 4 years terms. This flexibility helps individuals commit to saving small amounts over time.

- Automated Deductions: The bKash app allows for automated deductions from the user’s wallet, ensuring that deposits are made on time without requiring manual intervention.

The key features of the loan are –

- Fully digital process, from application to installment to encashment

- No paper or bank account needed

- Realtime tracking of DPS plan from bKash app

- Multiple DPS account from one bKash account

- bKash automatically deposits installments from the user’s account to the DPS account on the specified date

- Upon maturity, the total amount, including interest, is transferred back to the bKash account

- Customers can withdraw funds from agent points without charges

Impacts of bKash DPS

Since the introduction of monthly DPS in 2021, and the more recent weekly DPS, customers have opened over 2.7 million DPS accounts through bKash, collaborating with four commercial banks and a financial institution: BRAC Bank, Dhaka Bank, Mutual Trust Bank, City Bank, and IDLC Finance. And 30% of these DPS accounts owned by women. Also, the short-term digital weekly DPS introduced by bKash is the first of its kind in Bangladesh.

The bKash Digital Deposit Scheme (DPS) offers a variety of benefits to individuals looking for a convenient, flexible, and reliable way to save money over time. With its fully digital platform, bKash DPS provides a practical solution for many who may not have access to traditional banking or formal savings schemes. Here are some key benefits of using the bKash Digital DPS:

- Financial Security: By encouraging long-term savings, the DPS helps individuals build a financial cushion, which can be crucial for future needs like children’s education, healthcare, or retirement.

- Convenience: Unlike traditional DPS offerings, users do not need to visit a bank branch to open or manage their savings account. The entire process, from enrollment to tracking savings, can be managed through the bKash app.

- Inclusivity: The product is accessible to anyone with a bKash account, significantly broadening the scope of who can benefit from structured savings plans.

The bKash Digital DPS is a transformative savings solution, combining the advantages of mobile financial technology with the discipline of a formal savings plan. With its flexibility, accessibility, and security, the bKash DPS empowers people across Bangladesh to take control of their financial future, fostering a culture of savings and providing economic stability for the long term.

Concluding Remarks

Bangladesh is home to a significant portion of the population that remains unbanked or underbanked, especially in rural areas where banking infrastructure is limited. Traditional banks have historically been unable to reach these regions due to logistical and economic challenges. This financial exclusion has long kept many Bangladeshis from accessing essential services like savings accounts, loans, and pensions.

The introduction of digital loans and the Digital Deposit Scheme (DPS) by bKash has set a benchmark for inclusive financial services in Bangladesh. By providing accessible, flexible, and user-friendly financial products, bKash has made significant strides in bridging the gap between the unbanked and the formal financial sector. With continued innovation, investment in digital literacy, and supportive regulatory frameworks, the future of financial inclusion in Bangladesh looks promising, driven by the power of mobile financial services.