With the diverse adaptation of technology payments industry is undergoing significant transformation. Furthermore, the evolution of consumer behavior and changing expectations in relation to payments prompted the significances of technology to launch innovative products, services and business models. Tech-enabled businesses creating a completely different payments ecosystem, while traditional enterprises have been disrupted over time. The holistic influences are visible in the range of new opportunities that have emerged in recent times.

On the other hand, the ongoing transformation has led to multiple challenges and issues for the stakeholders. It varies from pertaining to data, security and regulations that are creating confusion among incumbents and new providers alike. Historically, banks have been the cornerstone of the payments ecosystem. But as consumer expectations evolve with digitalization, dissatisfaction with traditional payment options due to slow, complex and lacking agility and transparency.

On a different note, business-to-business (B2B) payments is a complex corporate function, especially for business with a global footprint. The systems are highly fragmented mainly due to multiple components and developments over the years. While organizations are struggling to adapt to new currencies, data rules and software, external considerations such as security concerns and a growing number of channels make it more complicated. The effective management of payments largely depends on costs optimization, diversification of revenue sources and working capital financing. Traditional banking services are not very agile and innovative to offering solutions that enable more intuitive methods of payment. The adaptation of tech-enabled solutions brings significant changes in the delivery and consumption of payment services across both the business and consumer arena.

PayTech is a FinTech sub-segment spanning companies that provide solutions, services or products to process payments in digital and physical world.

Source: Enterprise Ireland

Disruptive innovations are flourishing across various financial technology sub-segments which includes but not limited to peer-to-peer lending, management of assets, investments, payments and blockchain. Among the segments, payment segment experienced high disruption within FinTech. There are number of payment processes and schemes in action that are either carried out by banks or other electronic money and payment firms. The service of the processes and schemes includes national and international money transfers, bill payments, loyalty-based cashback, electronic money, intermediation of payments and payment channels.

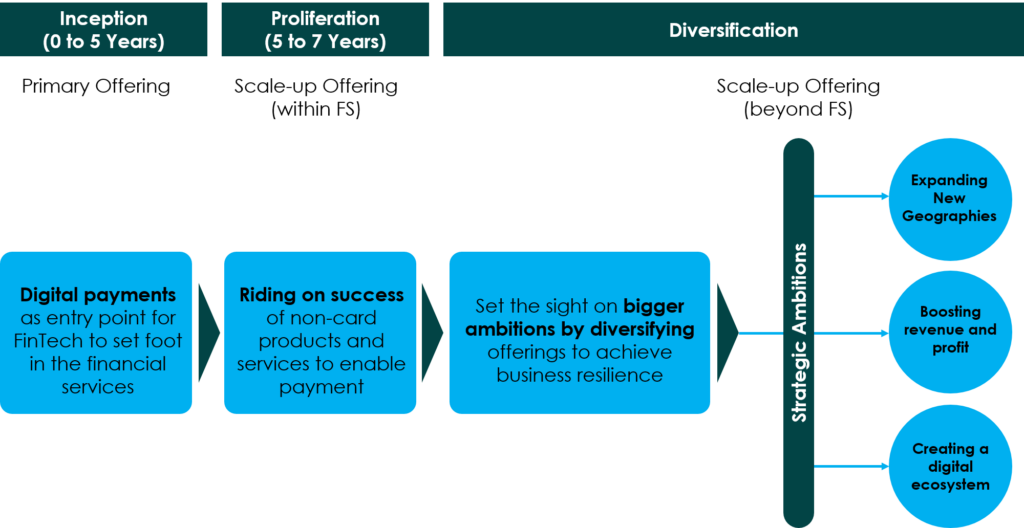

However, payments typically need to follow the regulations and frameworks prescribed for the banking industry. Thanks to consumer demand and expectation with all the regulatory limitations, PayTechs already in Payment 4.X era by enhancing scale and capability beyond the financial services. But the limited revenue from transaction and interchange fees brings low profitability and lack of sustainability challenges. To attain profitability and ensure long-term business sustainability PayTechs rely on diversification.

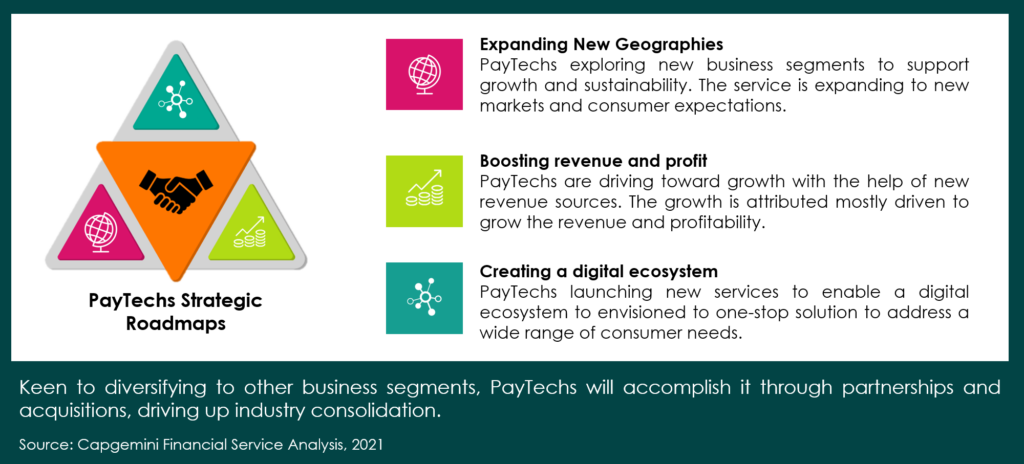

With low barrier-to-entry, payment remains the easiest market entry gateways for financial service providers. But the profitability and business sustainability largely depends on ability to expand the services beyond the payment functions. In a recent analysis Capgemini outlines the various strategic roadmaps PayTechs are using to achieve profitability and business resilience.

With the help of evolving technical developments, PayTechs are branching out into a wide range of services that essentially complements different financial and non-financial services. The service includes wealth management, personal financing, budgeting, brokerage, insurance and entertainment. The global PayTech cases that expanding to other functions can be summarized through below table –

The strategic diversification will give an edge to PayTechs over incumbents in various ways. Over the years, PayTechs are diversifying its scope of products and service delivery to achieve the profitability and business model sustainability. Through financial services PayTechs entry to the FinTech but over the period of time the firms are expanding the scope to non-financial services to ensure business resilience.

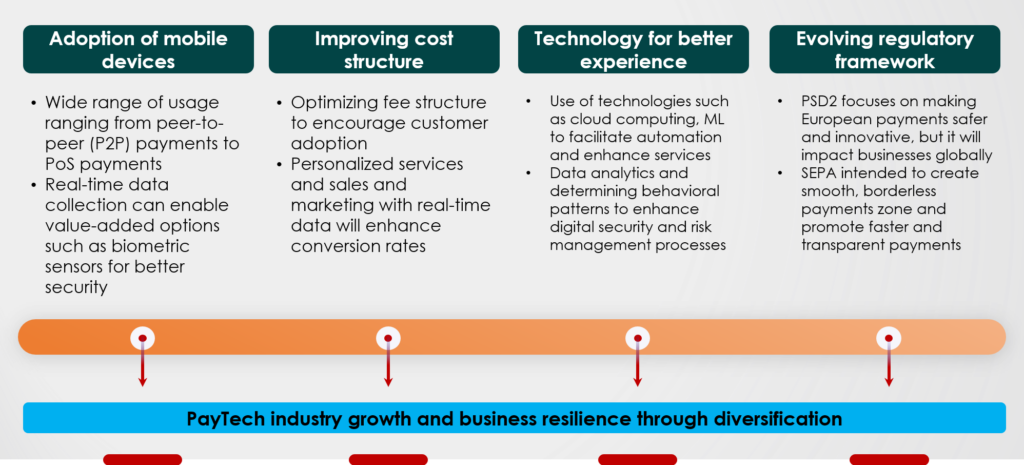

PayTech ecosystem is still evolving and far from the maturity stage of industry lifecycle. The growth of payment technology largely depends on the strength of the ecosystem and developments in the support systems that span technology and regulations. Furthermore, partnerships among different stakeholders will act the driving force for creating a stronger ecosystem. The factors driving PayTech industry growth can be attributed as below –

According to Capgemini report in 2022 and years ahead PayTechs will evolve as an enabling functions for customer reach and user experience. The diversification PayTechs industry experiencing will give the firms edge over incumbents through technological agility and data processing. Shared infrastructure and data intelligence of PayTech will act as the significant driver for implementing Payment 4.X era.