The COVID-19 pandemic already accelerated the rate of digital adaptation in financial services with unprecedented change in human behaviour over transaction patterns. The Deloitte report on digital transformation suggest four fundamental shifts aimed to the pandemic –

- Forced adaptation of online, mobile and call canter channels.

- 35% of customers have increased their online banking usages during COVID-19.

- Tipping points for digital and contactless payments.

- VISA saw more than 13 million customers in Latin America make their first-ever online transaction in march quarter of the year.

- While MasterCard reporting m0re than 40% growth in contactless transactions globally.

- Overnight visualization of workforce and way of working

- Evolution of underlying market structure and economics

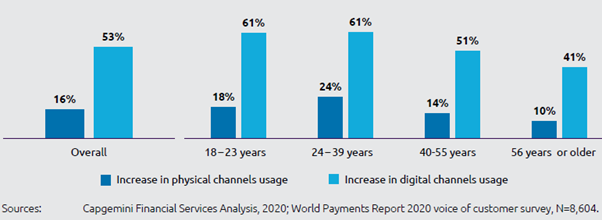

The consumer shift from cash to digital payment grows significantly over the last couple of months. The Capgemini Financial Service Analysis Report 2020 suggest increase in digital channels usage across the lifecycle of consumers. Comparing to the physical channels usage the growth rate falls between 50% to 100%. The below analysis can be presented as synopsis to the overall digital channels adaptation.

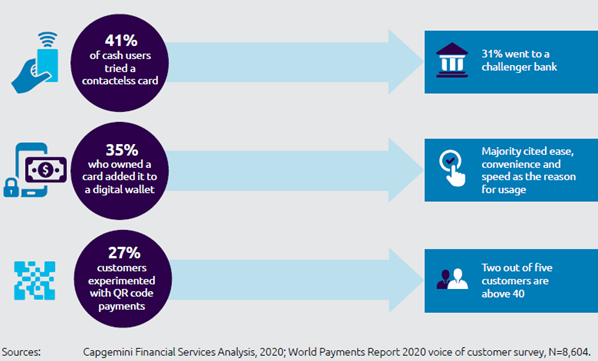

Furthermore, the report indicates the usages of digital payments services increases dramatically across the globe. The growth rate in contactless card, digital wallet and QR based payment promises a higher adaptation in coming days.

Today, payments have become a “commodity,” with consumers embracing models that offer greater value. A combination of consumer demand, emerging technologies, market competition and regulatory push has boosted the electronic payments segment.

Considering the shift in payment landscape, Deloitte summarized payments trends shaping 2020 in five components –

- Competition between closed and open payments platforms

- Evolving payments economics

- Development of new standards to govern the flow of money

- Non-commercial entities’ role in shaping the ecosystem

- The future of payments organizations and talent implications

Digital Payment Trends in 2020: Bangladesh Perspective

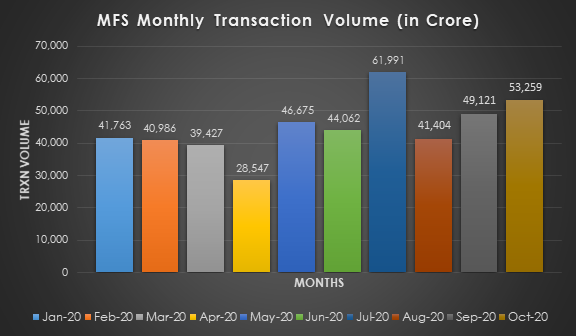

The COVID-19 pandemic also bring shift in consumer behaviour in Bangladesh in noticeable numbers. The usages of digital payment system in Bangladesh also eying in greater scope for digital transformation. The MFS transaction grows significantly aimed to the COVID-19 in Bangladesh.

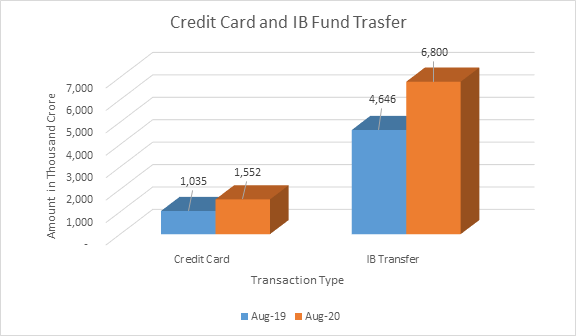

The MFS transaction data through the mobile financial service platform, reaches sky high during the month of July with BDT 61,991 crore taka. In October the total transaction volume stood at Tk 53,259 crore in October, which is 41 per cent higher than that of October 2019. October’s figure, which is up 8.5 per cent from a month earlier, is the second-highest since MFS was introduced nearly a decade ago. The other forms of digital payment also witnessed higher growth in recent months. The credit card transaction and usages of internet banking indicates that the pandemic has fast-tracked the digital transformation for payments as people avoided handling banknotes for fearing of catching the virus. The following data of Bangladesh bank on credit card transaction and internet banking can be evidential for the digital payment growth of Bangladesh.

In August 2020, credit card transactions stood at BDT 1,552 crore, up around 50 per cent from a year earlier, according to data from the Bangladesh Bank. While internet banking fund transfer in August 2020 stood at BDT 6,800 crore, up around 46% from the same of August 2019. A significant growth comes as the conscious people moved away from the use of cash and go to the digital transactions.

The pandemic causes a huge rise in digital services like e-commerce, online/app based grocery and food delivery to avoid the mass crowd. The consciousness of the people giving momentum to the digital transformation big way. In coming days, the digital transformation will gain mammoth growth as this is slowly but surely becoming a part of people’s daily life behaviour.

On regulatory perspective, Bangladesh Bank is working on digital transformation of payment and financial system for last couple of years. The initiatives already taken by the central bank to create an infrastructure for the stakeholder players. The NPSB for interbank transfer already there, while interoperability among the MFS and banks is another significant initiative from the central bank. Besides, few other policies and guidelines published by Bangladesh Bank to create an operable infrastructure for the payment landscape in Bangladesh.